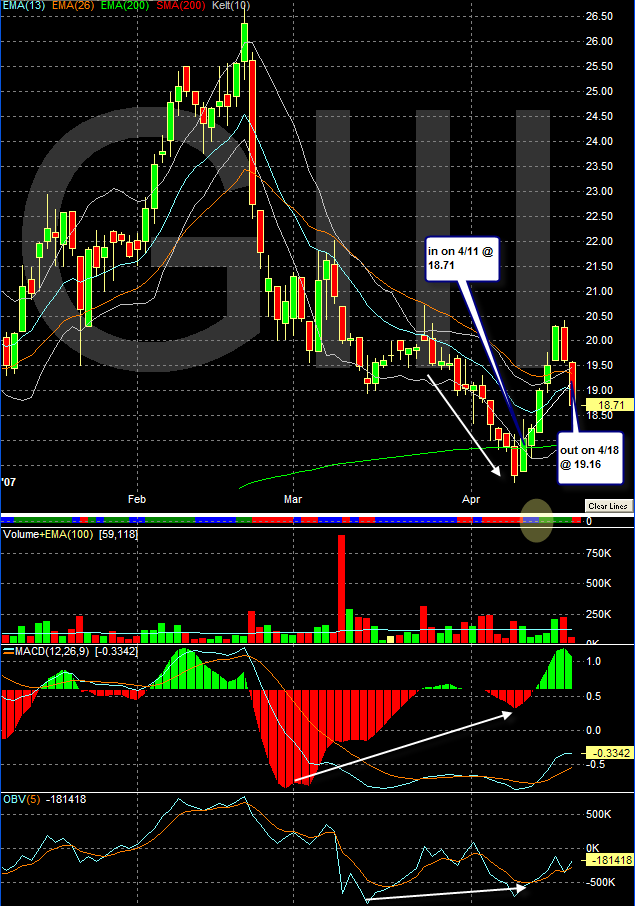

Here is a quick review of a recent trade on GIII. I got in on 4/11 @ 18.71 and got out on 4/19 @ 19.16. It is nothing to write home about since I only captured 0.45 out of a trend which spanned almost 3.00. The candidate itself was good and there a nice 5 day upswing to capitalize on, which is what I look a lot, but unfortunately, I missed my entry and my exit, leaving with only small gains.

I found this candidate using a “down for 5 days or more” scan. I typically look for stocks down for several days in a row, with decent volume and still above their 200 days price moving average. This one fit the bill. When I started looking at it, it was pulling back towards the EMA200 line, sitting right on the lower channel. The MACD histogram had traced a good divergence and the MACD line also. After several days or red impulse, I finally got a blue signal meaning I was permitted to trade long.

My entry was horrible, right at the top of the body candle on 4/11 which is where I do NOT want to be. Getting in at the low is hard but I should have been able to get in mid-candle, around 17.60-17.70. So I lost .30 on the trend here.

My exit was also horrible. I forgot to move my stop on the days low on 4/17. Had I done so, I would have been stop out when the prices reached those levels on 4/18. Instead, I got out on a old un-ajusted stop from 4/16, losing another .50 on the trend in the process.

Lessons learned as they say.

Happy Trading!